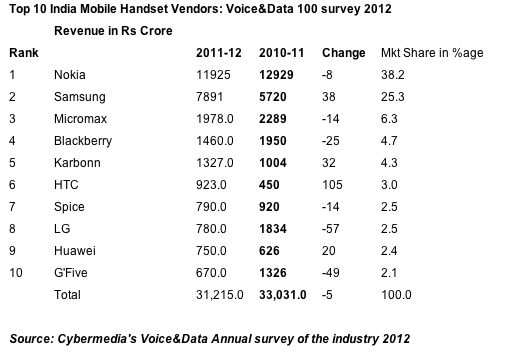

Fall in India-specific revenues of mobile handset makers including

Nokia, RIM and LG, led by de-growth in feature phone sales and lower

average selling values pulled down industry-wide sales by five per cent

to Rs. 31,215 crore in 2011-12, says a Voice&Data survey.

The

survey said the mobile handset sales in India stood at Rs. 33,031 crore

in the previous fiscal. It also said the main stay of domestic handset

makers like Micromax and Spice (feature phones) saw negative growth,

while the entry level smartphones of various companies saw a marginal

rise.

The annual survey on Indian Telecom industry by CyberMedia

group's journal Voice&Data attributes the total revenue drop to

lower average selling values (ASVs) as well.

"Indian mobile phone

brands that had hoped to make a mark by sourcing Chinese handsets and

selling them only on the price plank were in for a big surprise. These

players will have to quickly rethink their product, marketing and

service strategy afresh to put their house in order," Voice&Data

Group Editor Ibrahim Ahmad said.

India is one of the fastest

growing telecom markets in the world. However, in the last few months,

the growth rate has slowed down from monthly additions of 12-15 million

to 7.99 million in May 2012.

As per the survey, Nokia retained its

leadership with 38.2 percent share. However, its revenues have fallen

7.7 percent to Rs. 11,925 crore in 2011-12 from Rs. 12,929 crore in

2010-11.

The Finnish company lost market share in smartphones and

multi-media segment to Samsung, HTC and Apple, among others, but made a

headway in the dual SIM phones category, it said.

Korean handset

giant Samsung, on the other hand, saw its revenues growing 38 percent to

Rs. 7,891 crore in 2011-12 from Rs. 5,720 crore in the previous fiscal.

It had a market share of 25.3 percent, thanks to its rich product

portfolio based on Windows, Android and Bada operating systems, as per

Voice&Data.

Samsung's Galaxy Note, a hybrid between smartphone

and tablet was a trailblazer, selling 40,000 units each month since the

launch in late 2011, the survey said. "As consumers look for

applications beyond voice and SMS the market will see fight for high end

feature phones and smart phones intensify further. Consumers can also

look forward to steeper price drops and more features in the same

price," Ahmad said.

Homegrown handset company Micromax ranked

third on the list with revenues of Rs. 1,978 crore with a market share

of 6.3 percent. Its revenues dipped 13 percent compared to the previous

fiscal. BlackBerry maker Research in Motion's (RIM) revenues dropped 25

percent to Rs. 1,460 crore. With a market share of 4.7 per cent, it

ranked fourth in the list.

The steepest fall was seen in the

revenues of LG, which fell by 57 per cent to Rs. 780 crore in 2011-12

from Rs 1,834 crore in 2010-11.

Taiwanese handset maker HTC, on

the other hand, saw its revenues more than doubling to Rs. 923 crore in

2011-12 from Rs. 450 crore. Its market share stood at three percent.

Other

key players in the Top 10 list include Spice (Rs. 790 crore), Huawei

(Rs 760 crore) and G'Five (Rs 670 crore). It surveyed over 30 mobile

handset firms -- both multi- national and Indian -- selling feature

phones, multimedia phones, enterprise phones and smartphones in India.

No comments:

Post a Comment